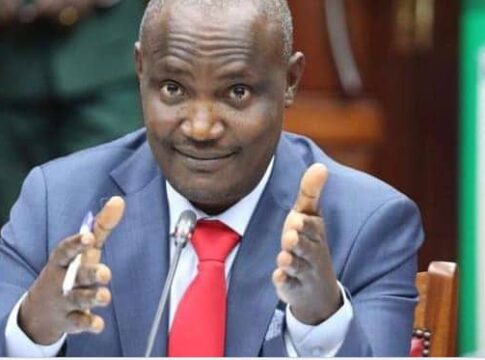

In a bid to resuscitate its economy, the Kenyan government is contemplating a significant reduction in Value-Added Tax (VAT) and Corporate Income Tax. This ambitious plan, announced by Treasury Cabinet Secretary John Mbadi, aims to alleviate the financial strain on citizens and businesses, thereby stimulating economic growth.

According to Mbadi, the proposed tax cuts are designed to “alleviate the financial burden on citizens and businesses” and “promote economic expansion.”

By reducing VAT, the government hopes to increase consumer spending, while lower Corporate Income Tax rates are expected to encourage business investment and job creation.

READ MORE: Ajuri Ngelale Steps Down As President Tinubu’s Spokesman, Tackles Personal Health Crisis

While some have welcomed the proposal as a much-needed boost to the economy, others have expressed concerns about the potential impact on government revenue and public services.

As Mbadi noted, the government must carefully balance its efforts to stimulate economic growth with the need to maintain essential public services and infrastructure development.

The proposed tax cuts are part of a broader effort to revitalize Kenya’s economy and improve the business environment.

As the government moves forward with its plans, it will be important to monitor the impact on the economy and make adjustments as needed.

By taking bold action to address its economic challenges, Kenya may be able to unlock a new era of growth and prosperity for its citizens.