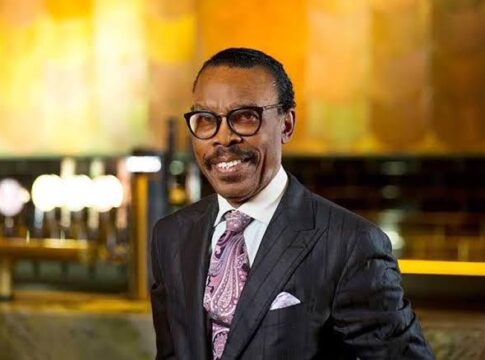

Nigeria has poured $8 billion into defending the naira, but inflation remains a growing concern. The massive intervention, revealed by Bismarck Rewane, CEO of Financial Derivatives Company, highlights the government’s ongoing struggle to stabilize the currency amid economic turbulence.

Speaking on Channels Television’s News at 10, Rewane noted that in addition to these interventions, Nigeria has also borrowed $4 billion through bond issuances, further increasing its debt burden. Despite these efforts, the naira continues to face intense pressure, with inflation data presenting conflicting narratives.

Nigeria recently rebased its inflation calculation, resulting in significantly different figures.

The National Bureau of Statistics (NBS) defined rebasing as a process of updating an old base year with a recent one to reflect changes in the prices of goods and services produced within the economy.

READ MORE: NDLEA Cracks Down on Trans-Border Drug Cartel, Seizes 190,960 Tramadol Pills

According to Rewane, the old method placed inflation at 34.8%, the rebased data suggested a lower 24.4%, while market surveys indicate real inflation is closer to 33%. He questioned the sharp drop, arguing that ordinary Nigerians “do not feel” this decline in their daily expenses.

Inflation Data Sparks Debate

The Central Bank of Nigeria (CBN), under Governor Olayemi Cardoso, insists that monetary policies are yielding positive results. The Monetary Policy Committee (MPC) recently held its benchmark rate at 27.50%, citing a stabilizing foreign exchange market and a stronger naira. However, food inflation remains a major challenge, driving up living costs despite official reassurances.

Rewane remains skeptical, stating that “there’s no way inflation can drop by 10% so quickly” without real changes in consumer prices. Many Nigerians share this sentiment, as market realities continue to reflect a high cost of living despite government reports suggesting otherwise.

What’s Next for Nigeria’s Economy?

With $8 billion spent and borrowing rising, questions remain about the long-term sustainability of Nigeria’s currency defense strategy. If inflation figures continue to diverge from economic realities, public confidence may weaken further.