By our Correspondent

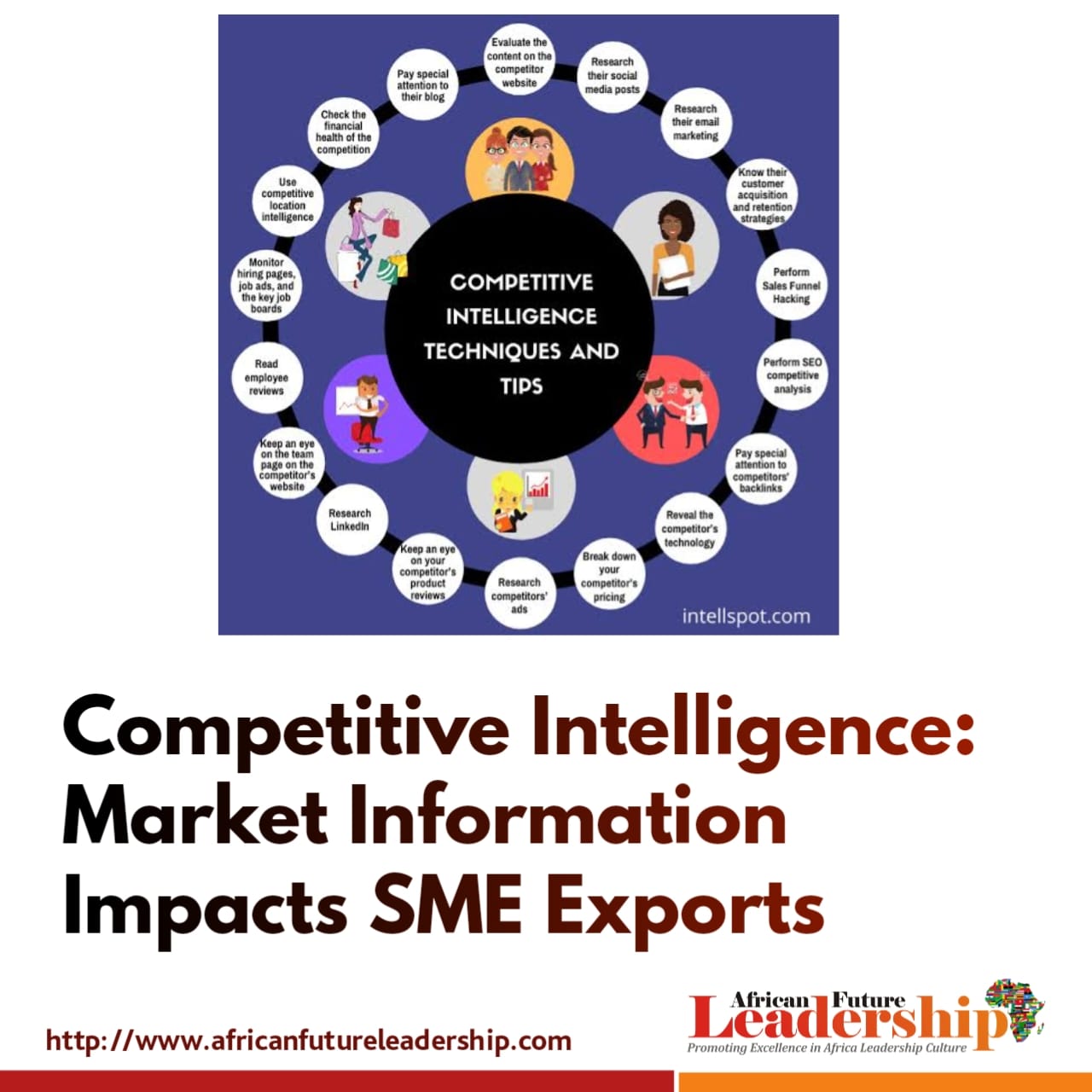

It has been widely acknowledged that Intelligence is not a preserve of political and security operatives, but the business community as well. So, welcome to Competitive Intelligence (CI), a process and product which transforms gathered competitor and market information into actionable knowledge.

Very Informatively, this is based on competitor’s capabilities, intentions, performance and position, as well as the final product of that process.

Thus, Competitive Intelligence is 100% legal and should not involve any underhand methods. In extreme cases, countries can be accused of economic espionage.

READ MORE: ECOWAS Condemns Coup Attempt in The Gambia

For instance, former US president Donald Trump alleged that China is involved in intellectual property technology theft from US companies. China’s response is companies doing business in their territory must incorporate technological transfer. This is CI power-play between superpowers.

Therefore, CI answers the cause of nontariff barriers (NTBs) that led Kenya to block Uganda’s dairy and poultry exports recently.

Interestingly, last year alone, Uganda exported goods worth $523m to Kenya compared to imports worth $793m in the same period. These figures reflect a trade imbalance between Uganda and Kenya to the tune of $270m. This is because we import more than export to Kenya.

Meanwhile, Kenya’s plan to maintain this dominance by normal market forces is within the rules. The marketplace is the most democratic space, with buyers, acting as voters, determining the rate of purchase of products. However, NTBs are used to maintain the status-quo. So, Uganda’s business community asks for fair play.

Overall, President William Ruto of Kenya has called for open borders in the East African Community (EAC), advocating for scarcity of products in Kenya to be sourced from neighbouring Uganda.

Instructively, this is how regional economic blocs function. Let’s take a close look at milk. The cost to produce one litre of milk in Uganda is lower than in Kenya. When Uganda’s milk traders export to Kenya, they are more competitive on price and quality.

Again, since the EAC is a common market with duty free and quota free exports, including free movement of all factors of production, this should grant safe passage. However, NTBs are used as a tool for suffocation. Market forces of demand and supply are thrown out the window.

Significantly, however, CI uses political, economic, social and legal factors to ensure that the business community meets its objectives. CI is multi-pronged in nature. This business discipline is a full time job. Foreign embassies in Uganda are not here to serve cocktails and wine, but engage in CI. Commercial attaches at diplomatic missions analyse the business environment, digging out opportunities for trade and investment. As we wind up 2022, Uganda’s ambassadors are returning for Christmas holiday. Which competitive intelligence information will be shared with the ministry of foreign affairs and counterpart ministry of trade, industry and cooperatives?

READ MORE: WhatsApp Will Stop Working on Android and iOS Devices in 2023

The puzzle is, Small and Medium Enterprises are not in the best position to gather and analyse market information. Too much info can cause indecisiveness.

Thus, trade consultants and foreign trade representatives help SMEs follow market changes, interpret stakeholder moves and promote country interests.

Which is why the main components of CI are business monitoring, influence actions and information security.

Furthermore, like political security meetings, not all sessions are open door. They should be structured at different levels and information dissemination should be strategic. This ensures the country meets the objectives of Uganda Manufacturers Association (UMA) and Private Sector Foundation Uganda (PSFU), whose members desire to increase exports in the East African Community (EAC).

Strategically, in South Africa and China, CI heavily boosts their exporting companies. Moreover, Competitive Intelligence is based on facts. So, the next time you enjoy a glass of wine at an embassy party; just know there is a lot at stake.